- About UTFCU

- Account Questions

- Blog_CyberSecurity

- Checking Questions

- Debit Card Questions

- Digital Banking Questions

- Digital Banking Upgrade Questions

- General Product and Service Questions

- Loan and Credit Questions

- Membership Questions

- Miscellaneous Questions

- Security Questions

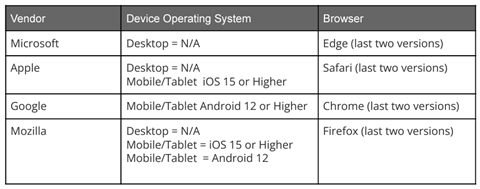

Yes. Please see below for the supported operating systems and browsers.

We will be enforcing new security protocols surrounding Virtual Private Networks (VPNs). If you use a VPN and are having trouble connecting to our system, try accessing it outside of your VPN.

Our upgraded Digital Banking platform has an improved look and feel, plus it includes new features to make digital banking easier:

- Card Controls –Activate a card, report as lost/stolen and request replacement cards.

- Credit Score (Powered by SavvyMoney) –View your credit score and a detailed credit analysis to stay on top of your financial health.

- Advanced Alerts – Stay informed of your account activity with instant alerts deliverable by email, text, or push notification.

- Live Chat– Talk to us in real-time from within Digital Banking.

- Enhanced Security – We added convenience while also using the latest security analysis and methods to protect your account.

- En Español– Easily toggle between English and Spanish versions.

Here are some simple things members can do:

- Ensure your contact information is up-to-date. We must have your current phone number on file for you to successfully receive a secure access code when you log into the upgraded system the first time. You can view and manage your contact info from inside of the current Online & Mobile Banking system by selecting Services & Settings, then Manage Contact Info. You can also give us a call at (865) 971-1971 or stop by any UTFCU branch. Your up-to-date information also ensures you receive important communication leading up to the upgrade.

- Know your credentials. You need to know your current username to ensure a seamless first login post-upgrade.

- Know your primary account number. The system will ask you to validate your account number. It’s validating against your account number with the most transactions. Use the account number of the account that you transact on most often.

- Turn on automatic updates for the app. Auto-updates ensure you automatically receive the newest version of our app when it is released, making login easy!

- Watch for more communication. Get the information you need for a smooth transition and keep an eye out for our tutorial videos and more.

The upgraded digital banking experience will launch on May 9, 2023.

UTFCU is committed to delivering an exceptional digital banking experience for our members. This upgrade ensures we can continue building and delivering the self-service tools you need to quickly and easily manage your finances. Digital banking will continue to be a free service available to all UTFCU members.

It may look a little different, but the functionality of Bill Pay is the same. All of your existing Bill Pay content and settings will carry over through this upgrade.

You will only need to set up or re-enter information for a couple of services once the upgraded digital banking platform is live:

- Alerts– The upgraded system will have new and improved Alert options that you will be able to utilize. Previous alert settings will be reset upon the upgrade.

- Financial Tools– Review any historical information you have now, as the upgrade will not be able to transfer any outside data you have loaded into the Financial Tools section on the current system. Any outside accounts you aggregated into Financial Tools will need to be relinked after the upgrade.

Digital banking will automatically transition to the upgraded platform. Current users will not need to fully “re-register”. Instead, you will login with your current username and password. You will be asked to confirm your identity via a few authenticating questions before being prompted to change your password.

The existing app version will no longer work once we start the upgrade process. The app icon that will become obsolete is the UTFCU logo on a white background.

You will need to have the newest version of our app once the upgrade is complete. If your apps update automatically, there won’t be any additional action to take. If not, you’ll need to manually update the app to the newest version after the system comes back online.

The newest version of the app will display an icon with the UTFCU logo on an orange background.

You may need to delete and reinstall the app if you are seeing the old app login screen and/or getting a server connectivity error.

![]()

Yes, your Intuit connection will need to be re-established.

Please take action to ensure a smooth transition. The instructions below reference two action dates:

- 1st Action Date: May 7, 2023. A data file backup and a final transaction download should be completed by this date. Please make sure to complete the final download before this date; transaction history may not be available after this date.

- 2nd action date: May 9, 2023. This is the action date for the remaining steps on the instructions you will need to complete to ensure your Intuit accounts are reconnected.

Please note: Express Web Connect will not be available until 5 business days after the 2nd Action Date, so please utilize another connectivity type if you need transaction updates during this downtime.

Your username and password will be the same when you first log in, however, you will be required to change your password once authenticated.