Get to Know Us: UT Federal Credit Union

Susannah’s House provides hope, healing, and stability for mothers and children in our community. Learn how UT Federal Credit Union is proud to support their mission and what’s next for this impactful organization. A heartwarming end to 2025! From spreading holiday cheer and volunteering with Tiny Trees, to celebrating World Kindness Day and supporting families through the Grocery Giveaway, UTFCU wrapped up the year giving back to our communities, connecting with students, and celebrating wins across Tennessee. From feeding families and supporting children to caring for seniors and animals, UT Federal Credit Union employees showed that small acts of kindness can make a big difference. Read about our 2025 Acts of Kindness Campaign and see how we’re spreading joy across Tennessee! From fundraising dinners to fall festivals, October was full of heart and community at UT Federal Credit Union. See how our team supported local causes, families, and traditions throughout the month. October is Cybersecurity Awareness Month! Learn how to protect your accounts with strong passwords, recognize phishing and scam attempts, and keep your personal information safe online. Discover how a UTFCU debit card gives you more than just spending power — from instant issuance at the branch to real-time alerts, fraud protection, and rewards, our cards are designed for convenience, control, and peace of mind. August was filled with community, connection, and celebration! From supporting agriculture and healthcare to welcoming students back to campus and spreading kindness through school supplies, UTFCU was proud to show up for Tennessee this month. From ribbon cuttings to hot dog cookouts, July was full of moments that brought our mission to life. See how UTFCU showed up to support innovation, education, and community. From food truck to full-fledged creamery, The Sugar Queen has become a Knoxville favorite by serving up small-batch ice cream and homemade treats—with a little help from UT Federal Credit Union. Discover how this family-run business turned their dream into a delicious success story. Online scams are rising on Facebook Marketplace and other social platforms. Learn the top red flags to watch for—and how UTFCU can help keep your money safe. From barn dances to civic summits, June was packed with inspiring moments. See where we showed up, lent a hand, and celebrated our Tennessee communities. Are you getting the most from your money? With UTFCU Relationship Rates, your everyday banking could earn you more and help you save on loans. Discover how simple it is to qualify and start maximizing your financial benefits today. From vacations to home upgrades to back-to-school shopping and unexpected expenses, a Summer Loan from UT Federal Credit Union can help you enjoy the season without breaking your budget. See how this limited-time offer could work for you! Catch up on all the ways UTFCU connected with our communities in May—from supporting students and local nonprofits to celebrating healthcare heroes and women's leadership. This month's recap is filled with moments of kindness, celebration, connection, and service. May is Mental Health Awareness Month, and financial stress is one of the biggest factors affecting our well-being. Learn how UTFCU and GreenPath Financial Wellness can help you reduce money-related stress and take control of your financial future. From galas to garden parties to financial education and fun runs, April 2025 was packed with purpose for UTFCU. Take a look back at how our teams showed up and gave back across Tennessee! Just bought a car? Don't hit the road just yet. Here's your checklist of everything to do after you drive off the lot—insurance, registration, budgeting, and more. From a single truck loan to a thriving landscaping business, Ian Dovan's journey with UTFCU is a story of growth, resilience, and community impact. Discover how Seeds of Change has flourished with the right financial partner by its side. Balancing caregiving responsibilities and financial stability can be challenging. Discover smart financial strategies to manage expenses, plan for the future, and access valuable resources to support your journey. UT Federal Credit Union's 55th Annual Meeting was a night to remember! From celebrating our commitment to education to honoring Debbie Jones' incredible 29-year legacy and welcoming our new CEO, Kenyon Warren, see all the highlights from this special evening. Scammers are using spoofing techniques to impersonate UTFCU and other trusted organizations. Learn how to recognize and protect yourself from these fraudulent calls. Make the most of your tax refund! Discover smart ways to save, invest, and grow your financial future with these strategic tips. Managing money in college can be challenging, but with the right tools and knowledge, you can set yourself up for financial success. Learn how to budget, build credit, manage student loans, and protect yourself online. Plus, discover how UTFCU can support your financial journey with expert guidance and resources! It's never too late to start planning for retirement! Discover practical strategies, the power of compound interest, and how UT Federal Credit Union can help you secure your future. Start your journey today! Is it time to refinance your loan? Discover 5 signs that refinancing could help you save money, lower your payments, or better align with your financial goals. Learn how UT Federal Credit Union can guide you through the process! Achieve your financial goals in 2025 with these simple, actionable tips. Discover how UTFCU's share certificates can help you grow your savings with guaranteed returns, competitive rates, and flexible term options tailored to you financial goals. The holidays are here, but so are the scammers! Learn how to spot and avoid the most common holiday shopping scams with these essential tips to protect your finances and personal information. Discover the mind games retailers play on Black Friday to make you spend more—and learn simple strategies to outsmart them! This blog is your go-to guide for making sense of personal finance terms, helping you make informed choices with ease. UT Federal Credit Union explains credit scores, interest rates, savings tools, and more—offering clear insights for managing and growing your money confidently. Explore a purpose-driven career with UT Federal Credit Union, where you can make a community impact, grow professionally, and enjoy work-life balance alongside competitive benefits. A healthy Debt-to-Income (DTI) ratio can open doors to better financial opportunities. This guide covers what DTI is, its impact on loans and credit, and steps to improve it. October is Cybersecurity Awareness Month—a reminder to protect personal information in today's digital world. UT Federal Credit Union is dedicated to equipping members with security tools and knowledge to stay safe. Buy Now, Pay Later (BNPL) services can make purchases feel more affordable, but they come with risks like late fees, credit score impacts, and overspending. Learn the pros and cons of BNPL, and how UTFCU can help you manage you finances responsibly. Fall brings unique expenses, from back-to-school to holiday shopping. This guide offers tips on budgeting, tracking expenses, and savings. Learn how UT Federal Credit Union's resources can help you manage fall costs while staying on track financially. While online banks offer convenience, UT Federal Credit Union provides a unique blend of digital ease and personalized in-branch service. Discover the value of local banking for financial wellness. Debt impacts your financial health in different ways. Whether tackling credit card debt or loans, learn practical tips and get expert guidance from UT Federal Credit Union to take control and achieve financial wellness. In times of crisis, scammers exploit people's generosity. UT Federal Credit Union urges caution when donating after disasters. Stay informed to protect your donations from fraud. During economic downturns, UT Federal Credit Union offers enhanced security and stability. We help members confidently navigate financial uncertainty. UT Federal Credit Union offers personalized mortgage solutions to help you navigate the competitive housing market. Be prepared and avoid missing key steps. This blog is packed with smart tips to maximize your savings during a tax-free weekend! Plan ahead, stick to your budget, and combine tax savings with other discounts. Plus, learn how UTFCU's U Rewards Checking can help you earn rewards on every purchase. This blog offers simple strategies to streamline your finances! Learn how UT Federal Credit Union can help you manage money more easily with personalized advice and account features. This blog highlights how we can support your small business with tailored financial solutions, flexible loans, and expert resources. Discover how UTFCU can help you reach your goals today! Discover how understanding and managing your credit score can help improve your financial decisions. Learn about factors like payment history and credit utilization, and find simple steps to boost your score. Learn how to explain the difference between needs and wants and introduce banking basics as they grow. UT Federal Credit Union offers practical guidance to help your children build strong financial foundations. Stay one step ahead of fraudsters! UT Federal Credit Union prioritizes your security and offers essential tips to recognize and avoid scams, including common tactics like phishing and social media fraud. Learn how to secure your financial information and monitor accounts effectively to keep your finances safe. Record-high temperatures mean finding refreshing ways to cool off is essential! Explore East Tennessee's waterfalls, enjoy a day at Dollywood's Splash Country, or take a relaxing float down the Tennessee River. Keep cool with these tips from UT Federal Credit Union. Unlock your home's potential with a Home Equity Line of Credit (HELOC) from UT Federal Credit Union! Let us support your journey to a more valuable, comfortable home. Protect your loved ones from elder fraud with UT Federal Credit Union's helpful guide on recognizing and preventing scams. We are here to support you with secure banking solutions and resources to keep our community safe. Learn how UT Federal Credit Union stands out with its member-focused approach, community involvement, and wide range of services. Find out how to join and experience the benefits of a not-for-profit credit union committed to serving you and the community.

A Place of Hope and Healing: Growing with Susannah's House

November & December at UTFCU: A Season of Kindness, Celebration, and Community

UT Federal Credit Union’s Acts of Kindness Campaign Spreads Joy Across Tennessee

Community Connections: October at UTFCU

Stay Safe Online: Cybersecurity Tips for UTFCU Members

The Top Debit Card Features You Should Expect

August Event Recap: Growing Connections, Building Community

July Recap: Serving, Celebrating, and Supporting Our Communities

Scooping Up a Dream with The Sugar Queen Creamery

Marketplace & Social Scams: What to Watch for and How to Stay Safe

June Recap: Celebrating Community, Culture, and Civic Engagement

Understanding Relationship Rates: How to Maximize Your Earnings with UTFCU

Is a Summer Loan Right for You? Let's Find Out!

From Kindness to Community: UTFCU in Action - May 2025 Recap

Your Wallet and Your Well-Being: How Financial Stress Impacts Mental Health

UTFCU in the Community: A Look Back at April 2025

Your New Car Checklist: What to Do After You Buy a Vehicle

Growing with UTFCU: How Seeds of Change Built a Thriving Business

Financial Strategies for Caregivers: Managing Expenses and Securing Stability

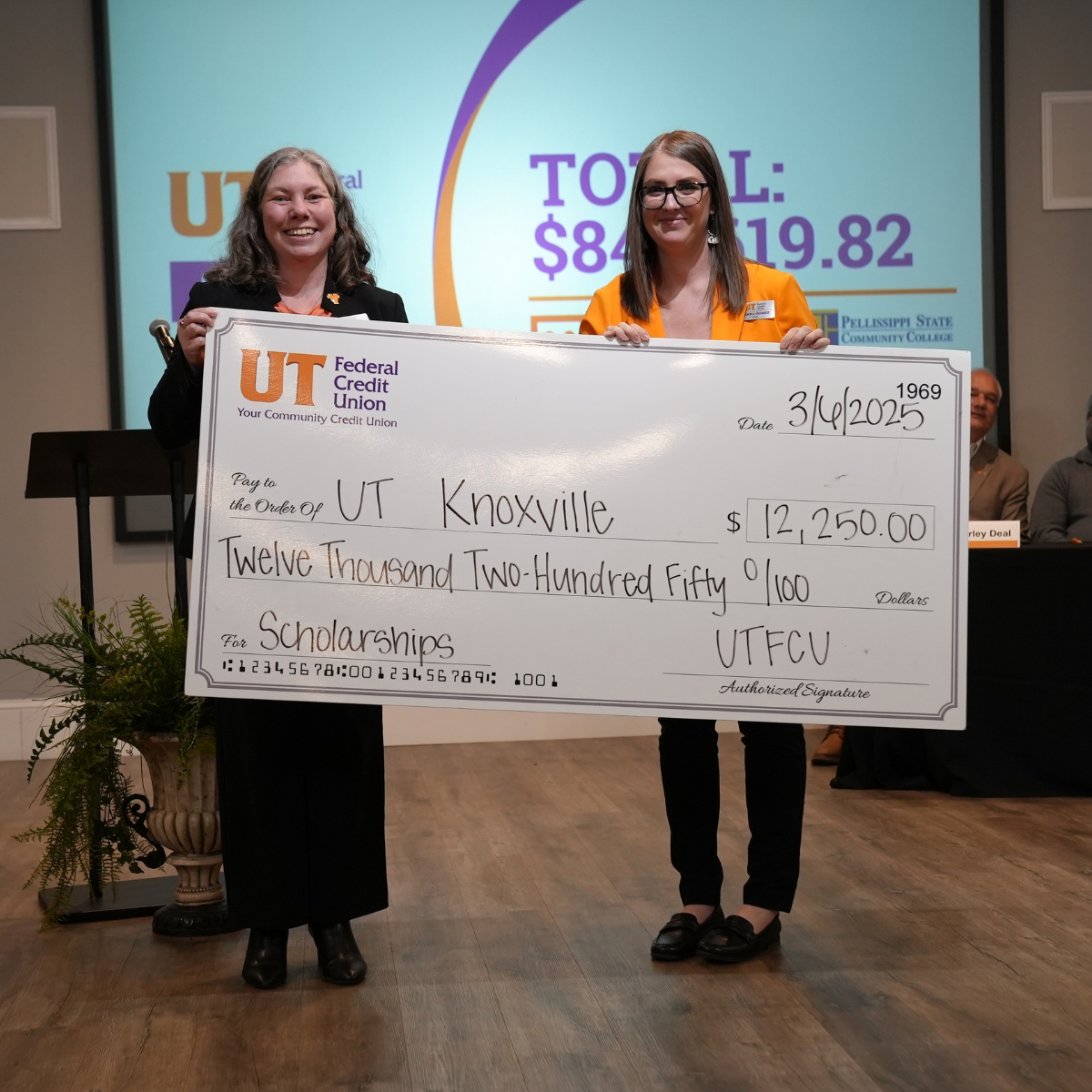

Reflecting on the 2024 UTFCU Annual Meeting

Beware of Spoofing Scams: Protect Your Personal Information

Maximizing Your Tax Refund: Smart Strategies for Financial Growth

Smart Money Moves: A College Student's Guide to Financial Success

Is It Too Late to Start Saving for Retirement?

5 Signs It Might Be Time to Refinance Your Loan

Start 2025 Strong with These Financial Resolutions

Unlocking the Benefits of Share Certificates at UTFCU

Stay Safe This Holiday Season: How to Avoid Common Shopping Scams

Black Friday Shopping Tips: Outsmart Retail Tricks to Save Big

Banking Jargon Decoded: Your Guide to Financial Terms

Building Careers with Purpose: The Credit Union Advantage

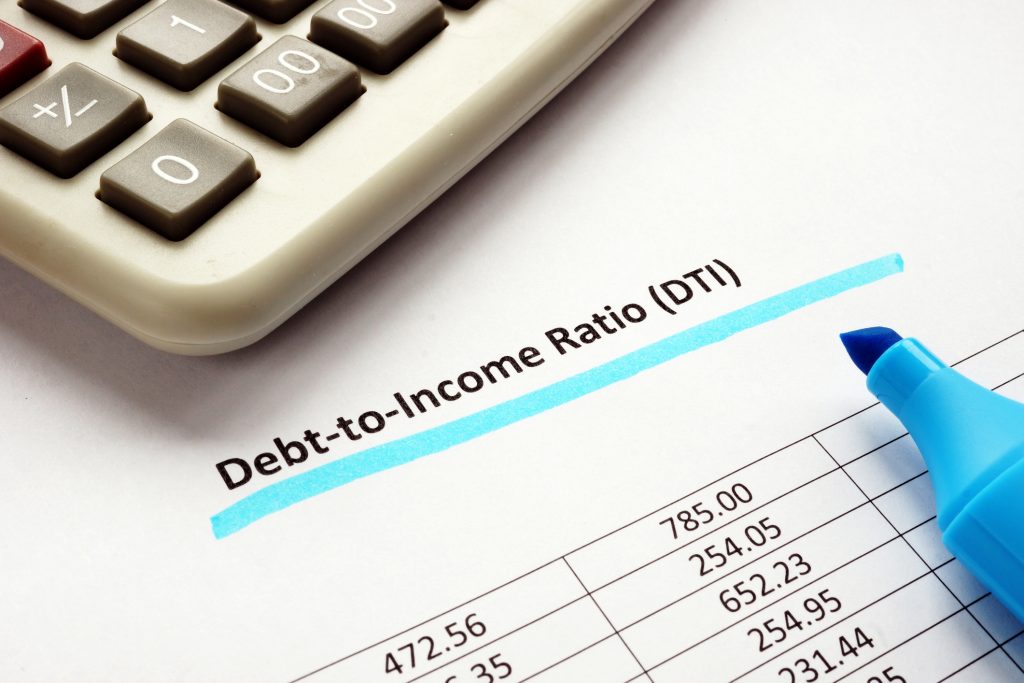

How to Improve Your Debt-to-Income (DTI) Ratio

Cybersecurity Awareness Month: How UTFCU Helps You Stay Safe Online

Buy Now, Pay Later: The Risks Behind the Convenience

How to Build a Fall Budget and Prepare for Seasonal Expenses

Credit Unions vs Online Banks: The Value of Local Banking

Understanding Debt and How to Manage It Effectively

Protect Yourself from Natural Disaster Scams

Why UT Federal Credit Union is Safer than a Bank in a Financial Crisis

What to Look for When Buying a House in a Hot Market

Maximize Your Savings This Tax-Free Weekend with UT Federal Credit Union

4 Strategies to Simplify Your Financial Life with UT Federal Credit Union

4 Ways UT Federal Credit Union Can Help Your Small Business Grow

7 Things You Need to Know About Credit Scores

How to Teach Kids to be Money Savvy

Protect Yourself from Scams and Fraud with UT Federal Credit Union

Beat the Summer Heat

How a HELOC Can Help: Transform Your Home with UT Federal Credit Union

Protecting Loved Ones from Elder Fraud

Get to Know Us: UT Federal Credit Union

Welcome to UT Federal Credit Union! We are thrilled to have you here and look forward to serving you. As a member-owned financial institution, UTFCU is dedicated to providing exceptional service to our members. Here’s a bit more about us and what makes us unique.

Our Mission and Vision

At UTFCU, our mission is to provide comprehensive financial solutions to our members while fostering a sense of community and mutual support. Our vision is to be the preferred financial institution for individuals and businesses in our service areas, promoting financial well-being and economic growth.

Our History

Established with a strong foundation in serving the community, UTFCU has grown to support members across Anderson, Blount, Knox, Loudon, Martin, Memphis, and Union Counties in Tennessee. Over the years, we have expanded our services and reach, continuously evolving to meet the changing needs of our members.

Membership Benefits

One of the key advantages of joining UTFCU is that we are a not-for-profit organization. This means that our profits are returned to our members in the form of lower rates, higher interest on deposits, and reduced fees. Here are some highlights of what you can expect as a member:

- Personalized Service: Our members are our top priority, and we are committed to providing personalized financial solutions that cater to your unique needs.

- Community Focus: We actively participate in and support local community initiatives, ensuring that our contributions have a positive impact.

- Member Ownership: As a member, you are an owner of the credit union. This gives you a voice in how we operate, with the ability to vote in board elections and contribute to decision-making processes.

How to Join

Becoming a member of UTFCU is easy and can be done in a few simple steps:

- Online Application: Visit our online application portal to complete the process from the comfort of your home.

- Visit a Branch: Stop by any of our branches with your government-issued ID, proof of address, Social Security card (if possible), and opening deposit. Our friendly staff will assist you in setting up your account.

- Give Us a Call: Contact us at (865) 971-1971 or (800) 264-1971, and we will guide you through the membership process over the phone.

Services We Offer

UTFCU provides a wide range of financial services designed to meet the diverse needs of our members. These include:

- Personal Banking: Checking accounts, savings accounts, money market accounts, IRAs, and more.

- Personal Loans: Auto loans, personal loans, student loans, mortgages, and home equity lines of credit.

- Business Banking: Business checking accounts, savings accounts, money market, lines of credit, commercial real estate loans, commercial vehicle loans, and SBA loans.

- Digital Banking: Online and mobile banking services to manage your accounts anytime, anywhere.

- Financial Education: Tools and resources to help you make informed financial decisions and achieve your financial goals.

Community Involvement

We take pride in our community involvement and strive to give back through various initiatives and programs. We focus on creating a positive impact and supporting the well-being of our communities.

Contact Us

For more information or if you have any questions, please feel free to contact us via email or call us at (865) 971-1971 or (800) 264-1971. You can also visit any of our branches or explore our website to learn more about our services and how we can assist you.

Join UT Federal Credit Union today and experience the benefits of being part of a member-owned, community-focused financial institution. We look forward to welcoming you!

« Return to "Blog"